The war in Ukraine is transforming global geopolitics and crude oil dynamics.

The war in Ukraine is transforming global geopolitics and crude oil dynamics.

On the geopolitical front, the United States has relentlessly rallied its allies against Russia. The Russian energy sector has still not been directly impacted by the sanctions. But the repercussions are apparent, even as the world is finding it hard to replace Russian oil, gas and coal.

Major energy industry players are avoiding Russian energy companies as much as they can. This has forced a tightness in the markets and gasoline prices are rising. At the gas station near my Ontario home, the price has hovered around $1.80 a litre over the past few days. This has added to inflationary pressures already created by supply chain issues caused by the pandemic-related chaos.

The U.S. and its allies are trying to counter by releasing an unprecedented volume of crude from their strategic reserves. And the U.S. is promoting itself as the energy supplier of last resort. Last week, Bloomberg reported that the U.S. is exporting the most oil and petroleum products in history as countries worldwide try to replace Russian supplies. Exports of U.S. crude and petroleum products surged to a weekly record of 10.6 million barrels per day (bpd) during the week ending April 15, data from the U.S. Energy Information Administration said.

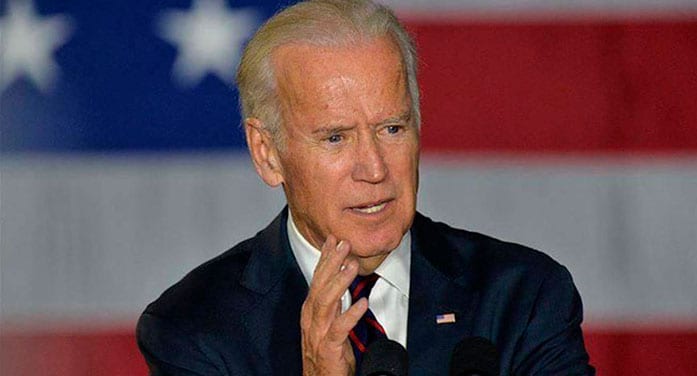

Yet, the U.S. Administration’s hands are tied. Its efforts to force the Organization of Petroleum Exporting Countries (OPEC) to open their taps don’t seem to be working. It’s been reported recently that leaders in Saudi Arabia and the United Arab Emirates have refused calls from U.S. President Joe Biden.

Now, Fox News and other media outlets are reporting that the U.S. has stopped asking Saudi Arabia to pump more oil to combat the market disruptions. The relationship between the U.S. and the oil-rich kingdom is said to have hit a new low.

Biden’s national security adviser Jake Sullivan reportedly brought up the 2018 killing of Saudi journalist Jamal Khashoggi in a meeting with the Saudi Crown Prince Mohammed bin Salman. This angered the prince to the point where he told Sullivan never to mention it again and to forget about Saudi Arabia increasing its oil production, the Wall Street Journal reported on Wednesday.

But during a recent call with Russian President Vladimir Putin, the prince agreed to continue maintaining the OPEC+ oil production pact. This was apparently their second such call since Russia’s invasion of Ukraine.

So OPEC is in a defiant mood. It told the International Monetary Fund’s steering committee on Thursday that the surge in oil prices was largely due to the Ukraine crisis, signalling that the producer group wouldn’t take much further action to add supply.

“Oil prices have been on the rise, particularly in March this year … mainly due to the escalating geopolitical tensions in Eastern Europe and concerns this might result in large oil supply shortages, amid trade dislocations,” Reuters said, quoting OPEC sources.

And all this has made the U.S. realize that it may be impossible for Europe, the main Russian market, to get rid of Russian oil and gas. A full European Union ban on Russian crude oil and gas imports could have unintended economic consequences for the United States and its Western allies, U.S. Treasury Secretary Janet Yellen told reporters in Washington on Thursday. She added that such a ban could do more harm than good.

Russia, meanwhile, is diversifying its customer base. Rather than focusing on Europe to sell crude oil and gas, Russia is now making serious efforts to sell much larger volumes in Asia.

China has always been a major trading partner of Russia and continues to be so. India is another customer buying from Moscow in greater volumes. According to Reuters, it has bought nearly as much in the first months of 2022 as it did in the whole of 2021. And it is refraining from criticizing Russia for its Ukraine invasion.

Pakistan was also offered Russian crude at 30 per cent less than the market price. The previous government in Islamabad appeared keen. The United States was unhappy and some people in Pakistan now think the U.S. orchestrated a regime change there as a result.

New alliances are emerging. The very structure of the global energy markets is transforming. And post-war, the landscape may have changed dramatically.

Toronto-based Rashid Husain Syed is a respected energy and political analyst. The Middle East is his area of focus. As well as writing for major local and global newspapers, Rashid is also a regular speaker at major international conferences. He has provided his perspective on global energy issues to the Department of Energy in Washington and the International Energy Agency in Paris. For interview requests, click here.

The opinions expressed by our columnists and contributors are theirs alone and do not inherently or expressly reflect the views of our publication.

© Troy Media

Troy Media is an editorial content provider to media outlets and its own hosted community news outlets across Canada.